What’s the best way to tell area residents about plans for a new asylum shelter nearby?

The government should tell communities directly about plans for new asylum shelters, some activists and politicians say.

One-parent families, people with disabilities, and renters have been particularly hard hit, according to a report from the Society of St Vincent de Paul.

Catherine Bromhead’s home electricity bill for May and June was €422.16, about twice what it was for the same period in 2021 – which she thought was high back then, she says, because she was home so much.

It’s not because she’d kept the heat on and lights blazing day and night or anything like that. Like so many people across Ireland, her provider had raised her rates.

Back in 2021, she was paying Energia €0.2118 per unit. Now she’s paying €0.4444 per unit.

“We are privileged in having a decent rent, and the ability to save so this did not impact us the way that it might for others,” Bromhead said by direct message.

“But we are currently trying to save for a home, and high bills like this impact our ability to save money as well as pay for other necessary expenses,” she said.

“And if this was our bill for Spring, I dread what we’ll have to pay when we need to use the heat again,” she said.

People across Ireland have been struggling to pay home energy bills, according to a March report from the Society of St Vincent de Paul.

Meanwhile, energy companies operating in Ireland reported billions in profits in their most recent annual reports.

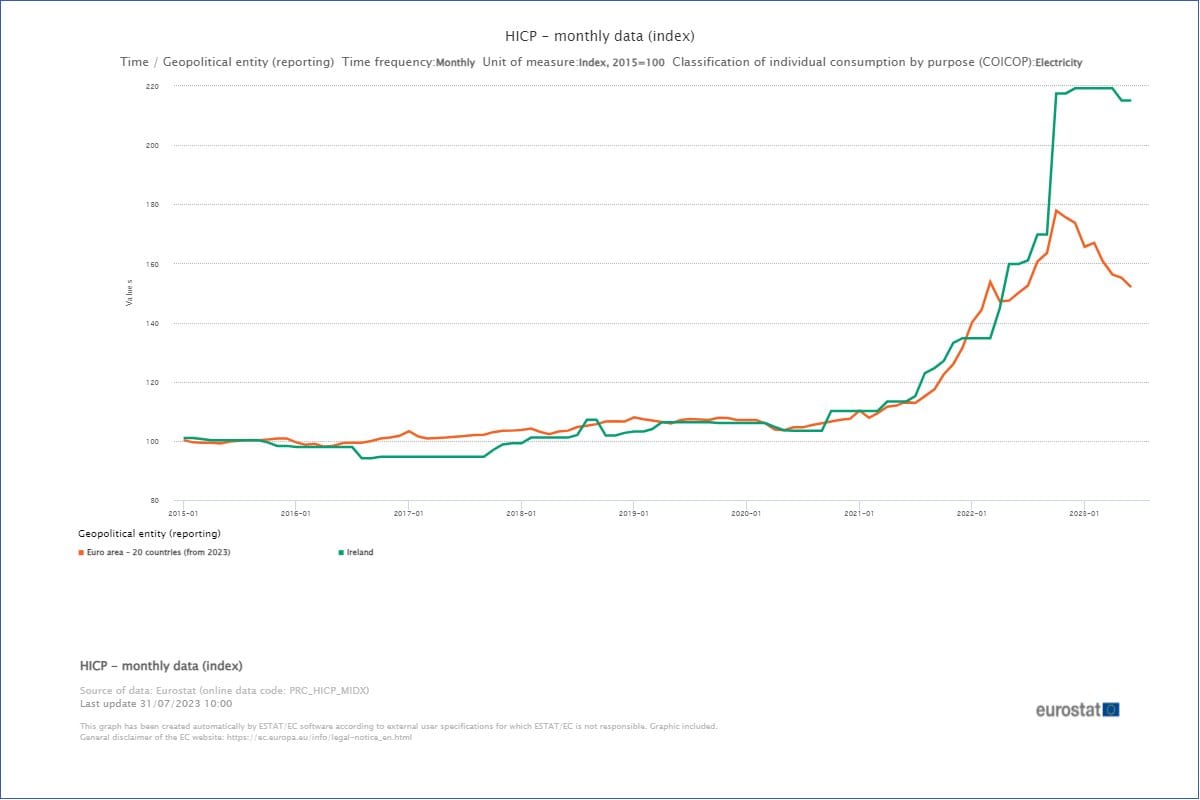

In the second half of last year, electricity prices in Ireland were the fourth highest in the EU by one measure, according to EU statistics organisation Eurostat. And, while electricity prices have been falling in the EU overall, they’ve only ticked down slightly in Ireland, according to Eurostat.

The Competition and Consumer Protection Commission has received complaints in relation to the energy sector, a spokesperson said. “These complaints were forwarded to our Enforcement Divisions to undergo screening.”

Meanwhile, the government has asked the Commission for Regulation of Utilities to look into whether there have been any market failures, a Department of Environment, Climate and Communications spokesperson said, “particularly where vulnerable customers are concerned”.

And it’s expected after the summer recess to push forward with a bill to tax energy companies’ “windfall” profits.

The largest energy companies operating in Ireland have all had increasingly large profits in the last couple of years, while charging customers high prices.

ESB, which is mostly state-owned, and includes Electric Ireland, reported an operating profit of €847 million in its 2022 annual report, up from €679 million in 2021.

Centrica, which owns Bord Gáis Energy, reported an operating profit of £3.3 billion in 2022, up from £948 million in 2021.

SSE reported an operating profit of £2.5 billion in their fiscal year ending 31 March 2023, up from £1.5 billion the previous year.

Bromhead’s electricity company, Energia, reported an operating profit of €354 million in their fiscal year ending 31 March 2023, up from €178 million the year before.

Meanwhile, her bill’s way up even as she’s worked to use less electricity. “Unplugging things when we don’t need them, only having the immersion on for an hour, at most. Turning off lights when we don’t need them, reducing appliance usage.”

She’s heard the explanations for why prices went up, but doesn’t understand why they can’t come down now.

“All explanations stem from the Invasion of Ukraine driving energy costs up,” she says. “However, I know for a fact that energy prices have come down significantly so there should be no reason for these continued high costs.”

Wholesale prices for natural gas, which is used to generate a large share of Ireland’s electricity, spiked in Europe with the full-scale invasion of Ukraine in February 2022.

Since then, though, wholesale gas prices in Europe have come back down – though not to their pre-war levels.

Data from Eurostat shows the prices EU customers are paying for electricity easing from a high in October 2022 and continuing to fall.

In Ireland, meanwhile, prices peaked comparatively higher, and later, and have only edged down a touch.

Energy companies are free to set the prices they charge consumers in Ireland.

The regulation of the electricity and gas markets is a matter for the Commission for Regulation of Utilities (CRU), a spokesperson for the Department of Environment, Climate and Communications said by email.

“The CRU no longer regulates prices”, the spokesperson said, but “it has a duty to ensure effective competition between suppliers, who are free to determine the price at which they supply electricity to customers”.

When energy companies are asked why their prices are still so high, they say – among other things – that their retail arms have not been not making profits.

While ESB reported an operating profit of €847 million in its 2022 annual report, Electric Ireland did not make any profit in its residential electricity business that year, a spokesperson said.

“In December 2022, Electric Ireland announced it would forego profit from its residential electricity business for 2022 and give a €50 credit to each of its residential customers,” he said.

“Over one million residential customers received this €50 credit at the start of 2023, at a cost to Electric Ireland of more than €55m,” he said.

Still, ESB reported large profits in other divisions. For example, it reported €774 million operating profits from its generation and trading division, and €207 million from ESB Networks.

The spokesperson for the Department of Environment, Climate and Communications said that for 2022, “ESB recommended a dividend to the State/Exchequer (enhanced on a once-off basis) of €327 million”, giving that money to the state.

“As a commercial semi-state body, all remaining ESB group profits are re-invested in the electricity network, renewable power generation and other important State-owned infrastructure,” he said.

A spokesperson for SSE said something similar to ESB about its retail arm not earning a profit in its most recent fiscal year.

“In April SSE Airtricity gave the entirety of our €8.6 million profit back to 247,000 customers in the form of household credits, following through on our commitment to forgo profits in full for 2023 to support customers through the cost of living crisis,” a spokesperson said.

SSE Airtricity is the SSE group’s retail arm in Ireland. The SSE group’s most recent annual report shows that its SSE Airtricity division had an adjusted operating profit of £5.6 million.

However, the same report shows that the overall SSE group’s operating profit for that period was £2.5 billion.

A Bord Gáis Energy spokesperson said the group “incurred a €30m loss in the first six months of 2023”.

“This was a result of our decision to absorb high energy costs to protect customers,” he said. “In addition, last year Bord Gáis Energy established an energy support fund which has provided €4.2 million to aid vulnerable customers to date.”

Bord Gáis Energy is part of Centrica, which reported an operating profit of £3.3 billion in 2022. For the six months ended 30 June 2023, it reported an adjusted operating profit of £2.1 billion.

Energia has not responded to any queries about its prices and profits sent 4 August.

As the energy companies have moved to return cash to the state, or their customers, the government has taken steps to ease the pain of high electricity prices for consumers – giving them electricity credits.

“Budget 2023 spread three €200 electricity credits evenly throughout the winter (when bills were highest),” said the Department of Environment, Climate and Communications spokesperson. “The most recent of these was applied to bills in the March/April billing cycle.”

The government is also looking at taking back some of the energy companies’ profits and returning those to customers too, the spokesperson said.

“The Government recognises that some fossil fuel companies and electricity generators have made unexpected extraordinary profits,” he said.

“To address this, the Government is bringing in measures to address windfall gains in the energy sector. Much of these windfall gains will be redistributed to consumers,” he said.

Still, people have to pay their electricity bills in the first place – and for those with budgets stretched paper thin, finding the cash to pay out can be tough.

And hoping for relief from ad-hoc rebates from the companies, or irregular credits from the government offers little comfort.

“The government should install a unit rate cap instead of subsidising costs at various intervals,” Bromhead said.

The increase in energy prices has pushed energy poverty up to its highest recorded rate, according to a June 2022 report from the Economic and Social Research Institute (ESRI).

“Energy poverty is an equality issue,” the report says. “As fuel bills go up, it is people and families on lower incomes that suffer the most.”

“In rapidly increasing numbers, households are facing the choice between putting food on the table, buying back-to-school clothes or heating their home. The increases in bills are already alarming,” it says.

As energy prices have risen, those hardest hit have been one-parent families and those unable to work due to illness or disability, according to the February 2022 report by the Society of St Vincent de Paul.

The share of one-parent families who couldn’t keep their home warm enough rose from 7.9 percent in 2021 to 21.5 percent in 2022, the report said.

The share of people unable to work because of illness or disability rose from 11.4 percent in 2021 to 19.5 percent in 2022, it said.

Renters have been hit harder than homeowners, it said. “Renters show a rate of 13.5%, almost double the previous year and almost three times the rate of owner occupiers (4.7%),” the report said.

The charity had been hearing from people who were having to cut their food budgets to keep up with their energy bills, people whose health had been hurt because they couldn’t keep their homes warm enough, people just stressed by the high and rising bills.

None of the four big energy companies agreed to provide someone to sit down with a customer struggling with their energy bills for a discussion of why they could not lower the prices they are charging.

The St Vincent de Paul report recommends that the government introduce “a social energy tariff, targeted at households on means tested social welfare payments”.

“This provides a medium-term solution that will bridge the gap between significant, but ad hoc, cash transfers from government, until the point at which households in energy poverty all live within retrofitted homes,” it says.

Why are the prices that energy companies are charging customers in Ireland still so high, even as prices elsewhere in Europe are falling – and even as the companies continue to make massive profits?

The main driver of electricity prices in Ireland has been gas prices in Britain, according to a document provided by a spokesperson for ESB.

Gas generated about half of electricity in Ireland in 2022, and most of that gas came from Great Britain.

“Across an 18-month period from mid-2020 to the end of 2021, prior to the onset of the conflict in Ukraine, wholesale gas prices increased in the region of 400%,” the spokesperson said.

Electric Ireland buys at least some of the gas it needs at fixed prices as far as 18 months in advance, and other bits less far in advance, according to the document.

Advance purchases mean that its gas costs for today are an average of – for example – the prices it paid 18 months ago, 12 months ago, 9 months ago, and so on. That reduces volatility.

It also means, however, that even after gas prices in Britain or wherever it’s coming from have fallen, Electric Ireland’s averaged-out cost will remain high for a while.

Still, there’s no law requiring companies to pass on increases in their own costs to their customers.

“Generally, there are no restrictions on the price businesses may charge and there is no obligation on traders to adjust their prices based on changes in the market affecting their products or services,” said a spokesperson for the Competition and Consumer Protection Commission.

There is a need to have enough income to cover costs to pay the company’s bills. But, again, ESB reported a profit of €847 million in its 2022 fiscal year.

However, not all divisions of ESB made a profit, the spokesperson said.

Electric Ireland is the group’s retail arm, buying electricity and gas and selling it to customers like Bromhead. ESB also has generation and networks divisions.

ESB’s annual report for 2022 shows its generation and trading division made a profit of €3.3 billion.

Its retail arm, which it calls “customer solutions”, and which includes Electric Ireland, meanwhile, reported an operating loss of €109 million.

“Electric Ireland did not make any profit in its residential electricity business for 2022,” the spokesperson said.

While there’s no law that a company has to pass all its costs on to its customers, ESB faces special restrictions as a former monopoly. It is not allowed to subsidise its retail division from profits in its generation division.

“All of these businesses are required to operate on a standalone basis,” according to a document provided by the ESB spokesperson in response to queries.

However, based on both EU law and Irish law, this only applies to ESB, as the former monopoly and distribution system operator.

Meaning that Bord Gáis, Energia, and SSE Airtricity could lower the prices they are charging customers – and offset losses in their retail arms with the profits from their other divisions.

An Economic and Social Research Institute report from June of this year included the hedging explanation for Irish retail electricity prices remaining high, but also suggested another possibility.

“Wholesale electricity prices have fallen significantly from their peak in the summer of 2022,” the report says.

“While these prices are still above their long-run average, the fall in wholesale electricity prices from their peak has not, to date, been reflected in any significant fall in retail electricity prices,” it says.

“There are several potential explanations for this. One is the possibility of anti-competitive behaviour, where firms fail to pass on a wholesale price decrease in order to boost profits,” it says.

This was an issue raised by Sinn Féin TD Pearse Doherty in a 2 August press release.

Referencing the Eurostat data on electricity prices, he said, “while electricity prices have fallen steadily across Europe, Irish electricity prices have remained sky high. This is despite the significant drop in wholesale energy costs in the past year.”

“In June the ESRI warned that the failure to pass on these reduced costs to households could be due to anti-competitive behaviour by energy companies in order to boost their profits.”

Neither Bord Gáis, nor SSE, nor Energia responded to queries sent on 4 August about Doherty’s statement. The ESB spokesperson referred the query to the Commission for the Regulation of Utilities (CRU).

“The CRU continually monitors the marketplace to ensure that it continues to function as required under EU legislation and that customers benefit as much as possible from this competition,” a CRU spokesperson said by email.

Competition law requires businesses to act independently and, broadly speaking, forbids agreements, decisions and co-ordinated business practices which prevent, restrict or distort competition in the market,” a spokesperson for the Competition and Consumer Protection Commission said by email.

“Specifically, in relation to pricing; businesses must act independently of their competitors and set their prices based on their own commercial strategy and circumstances,” she said.

The CCPC “investigates allegations of anti-competitive practices and we encourage anyone who may have evidence of anti-competitive behaviour to contact us”, the spokesperson said.

Get our latest headlines in one of them, and recommendations for things to do in Dublin in the other.