What’s the best way to tell area residents about plans for a new asylum shelter nearby?

The government should tell communities directly about plans for new asylum shelters, some activists and politicians say.

It’s a common refrain, but the figures just don’t bear it out, writes Mick Byrne of the Dublin Tenants Association.

After the most recent Daft.ie report, which showed yet another year of double-digit growth in Dublin’s rental market, the Irish Property Owners Association (IPOA) claimed that the problem is that landlords just can’t make money in today’s rental sector.

That’s right – the problem with double-digit rent increases, on top of the average 60 percent rent increases we already saw nationwide between 2012 and 2017 – is that landlords can’t make money.

Confused? You should be because this is nonsense. That hasn’t stopped the idea that landlords can’t make a buck and are fleeing the sector becoming a common refrain in media and policy debates.

The argument from the IPOA is that while rents are increasing and are at historic highs, landlords have mortgages and other costs to bear and so are fleeing the market.

This is true in some instances, but when we take in the whole picture, it looks rather different.

***

Recent years have seen consistent growth in both the size of the private rental sector and in the volume of cash flowing in.

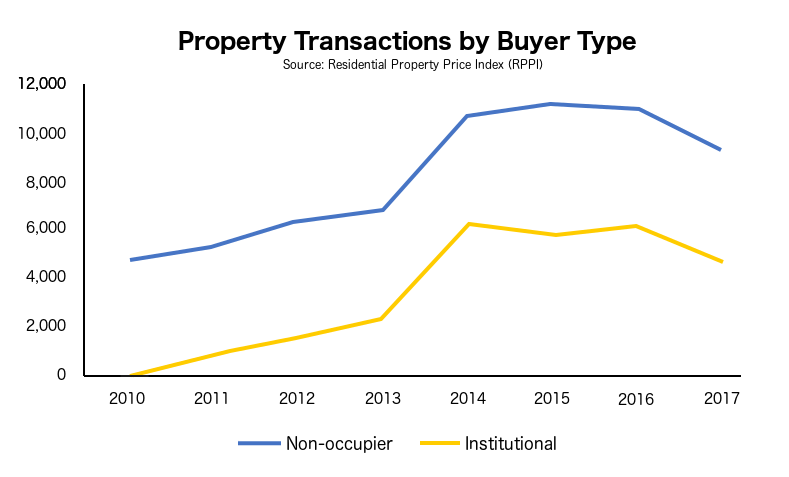

Renters, as a share of all households, have doubled since 2001. And while we don’t have exact data on the level of investment in the private rental sector, the Residential Property Price Index (RPPI) does show data for non-occupier and institutional buyers of residential property.

As you can see in the graph below, the data shows dramatic increases since 2010 (the first year for which we have data).

Note: Both of the above measures are proxy measures for investment in the private-rented sector. Non-occupier buyers includes holiday-home purchases and potentially parents purchasing for children. The data for institutional investors provided here is based on the RPPI’s “non-household” purchaser category, minus the figures for local authority purchases in each year. This gives an estimate of the volume of institutional investment in the rental sector. Although they are proxy measures, the exponential growth in both cases is likely to reflect, primarily, the growth of private-rental sector investment.

***

These increases should come as no surprise. The factors that shape investment in the rental sector are all increasingly stacked in landlords’ favour.

According to a Savill’s Ireland report from December 2017, gross yields on rental investments are around 5 percent. This makes them one of the best-performing asset classes around.

Other potential places to put your money, like a savings account or government savings bond, are offering returns of 1 percent or less.

The yield on an investment reflects the income returns, in this case, the rent received. The other thing investors care about is capital appreciation. Once again the picture is very rosy indeed for landlords: they’ve seen average increases of more than 50 percent in property prices over the last five years and analysts predict double-digit house prices increases over coming years.

But what about mortgage payments? If you listen to the IPOA and some other commentators you would be forgiven for thinking all landlords are up to their eyes in mortgage debt.

Once again, this isn’t true. As much as 60 percent of all rental properties have no mortgage attached to them.

There are a cohort of landlords who do have unsustainable payments, many of whom purchased between 2005 and 2008, but these are far from the majority or the norm.

Some estate agents report that currently a whopping 90 percent of all landlords they sell to are cash buyers, so once again, no mortgage.

The story spun by the IPOA doesn’t stand up to scrutiny.

It’s important to distinguish between the number of landlords and the number of rental properties. After all, having fewer landlords doesn’t necessarily lead to fewer properties to rent, given the potential for greater concentration in the market.

But even when it comes to the number of landlords, if the numbers registered with the Residential Tenancies Board are anything to go by, there has been an increase since 2014.

There were 212,306 landlords registered in 2012, which did drop to 179,026 in 2013, and further to 160,160 in 2014. But since then, the number has been climbing again.

There were 170,282 landlords registered with the RTB in 2015, which rose to 175,250 in 2016, and again to 176,251 by the end of September 2017.

This isn’t to say that some landlords aren’t losing money and getting out of the sector. The IPOA talk about this as something akin to a national tragedy.

But this is where we need a reality check. Investment in any industry does not mean a guaranteed return. The whole logic of a market society is that the most competent and effective investors are rewarded.

In any business, some will be successful and others will fail. The IPOA seems to follow the Irish banking sector’s school of thought, whereby it’s the government’s responsibility to make sure you make money on your investments, no matter what.

The consequence of some landlords leaving the sector is not a disaster for supply as is often claimed. If a landlord sells up, the property in question doesn’t vanish; it gets bought, either by an owner occupier or by another landlord, and therefore has no direct impact on the supply of housing.

Research from Savill’s Ireland states that the stock of rental properties in Dublin rose by more than 50 percent between 2011 and 2016.

Luckily, the IPOA says that it represents around 5,000 landlords. That’s a small proportion of those in the country. Despite this, armed only with anecdotal evidence and gargantuan sense of entitlement, they have managed to take up considerable space in the media discussion.

Some voices are fighting back, but tenants need to do much more to get their voices heard and shift the debate towards the real issues facing the rental sector.